Bill of Exchange

A Bill of Exchange is a financial instrument and a legally binding document used primarily in trade and finance to facilitate

payments. It is essentially a written order from one party (the drawer) to another (the drawee) to pay a specified sum of money to a third party (the payee) either immediately or at a predetermined future date.

Key Features of a Bill of Exchange:

Parties Involved:

Drawer: The person or entity that creates the bill and instructs payment.

Drawee: The person or entity on whom the bill is drawn, typically the buyer.

Payee: The beneficiary of the payment, who may be the drawer or a third party.

Unconditional Order: A bill of exchange mandates payment without any conditions attached.

Payment Date:

Sight Bill: Payable on presentation.

Term Bill: Payable on a future date.

Negotiability: Bills of exchange are transferable by endorsement, making them negotiable instruments.

Legal Framework: Governed by various laws like the Negotiable Instruments Act (in many countries).

Format of a Bill of Exchange:

A typical bill of exchange includes:

- The date of issuance.

- The amount to be paid (in figures and words).

- The names of the drawer, drawee, and payee.

- The date of payment (or “at sight” for immediate payment).

- The place where payment is to be made.

- The signature of the drawer.

Types of Bills of Exchange:

- Trade Bill: Used in trade transactions between buyers and sellers.

- Bank Bill: Drawn by one bank on another.

- Inland Bill: Drawn and payable within the same country.

- Foreign Bill: Involves parties from different countries.

- Clean Bill: Unaccompanied by supporting documents.

- Documentary Bill: Accompanied by shipping or other documents.

Advantages:

- Liquidity: Provides a source of short-term finance.

- Credit Facility: Allows buyers to defer payment.

- Ease of Transfer: Can be endorsed and transferred to another party.

- Legal Protection: Can be enforced under legal provisions.

Example of a Bill of Exchange:

vbnetCopy codeDate: November 28, 2024

To: Mr. John Doe

123 Main Street

City XYZ

Pay to the order of Ms. Jane Smith the sum of $5,000 (Five Thousand Dollars)

only on December 28, 2024.

Signed,

Mr. Peter Brown

Address: 456 Market Road, City ABC

Use in Trade:

Bills of exchange are commonly used in international trade, ensuring sellers receive payment and buyers obtain

What is Bills of Exchange ?

A Bill of Exchange is a financial instrument that is a written, unconditional order issued by one party (the drawer) directing another party (the drawee) to pay a specified sum of money to a third party (the payee) or to the drawer, either immediately or at a specified future date.

Key Characteristics of a Bill of Exchange:

- Unconditional Order: It mandates payment without any conditions.

- Three Parties:

- Drawer: The person who writes and issues the bill.

- Drawee: The person who is directed to pay the amount.

- Payee: The person or entity who will receive the payment.

- Legal Document: It is legally enforceable under the law.

- Specified Amount and Date: Clearly states the amount and when it is due.

- Negotiable Instrument: Can be transferred to another party by endorsement.

Example of a Bill of Exchange:

Imagine a seller sells goods to a buyer on credit. To ensure payment, the seller (drawer) writes a bill of exchange instructing the buyer (drawee) to pay a specific amount to a bank (payee) on a future date.

Uses of Bills of Exchange:

- Facilitates Credit: Enables transactions on credit with a clear timeline for repayment.

- Trade Transactions: Commonly used in both domestic and international trade.

- Short-term Financing:

Who is required Bills of Exchange ?

A Bill of Exchange is typically required by parties engaged in trade and financial transactions, especially when payment needs to be formalized, deferred, or guaranteed. The following parties and scenarios commonly require a bill of exchange:

1. Business Entities:

- Sellers (Suppliers): To secure payment for goods or services sold on credit.

- Buyers (Customers): To formalize an agreement to pay at a later date.

- Exporters and Importers: To ensure payment in international trade, where trust and legal enforceability are critical.

2. Financial Institutions:

- Banks:

- As intermediaries in trade financing, such as documentary bills for goods shipped internationally.

- For rediscounting bills of exchange to provide liquidity to businesses.

- Creditors: To document and secure repayment of loans or credit extended.

3. Individuals:

- When engaged in large or structured financial transactions, such as lending money or buying goods on credit.

4. Parties in Trade Agreements:

- To clearly define the payment terms between multiple entities and ensure accountability.

5. Government or Public Sector Entities:

- In cases where public infrastructure projects or contracts involve deferred payments.

Common Scenarios Where Bills of Exchange Are Required:

- Trade Credit: When a seller provides goods or services to a buyer with an agreement to pay later.

- International Trade: To safeguard payment between parties in different countries, reducing the risk of default.

- Loan Repayment: As evidence of an agreed repayment schedule.

- Debt Settlement: When restructuring or formalizing existing debts.

Importance of a Bill of Exchange:

- Legal Security: Acts as a written promise that can be enforced in court if payment is not made.

- Credibility: Helps establish trust between parties in a transaction.

- Negotiability: Can be transferred to a third party, allowing for flexibility in financial transactions.

In essence, any situation involving deferred payments, financial guarantees, or formalized transactions may require a Bill of Exchange.

When is required Bills of Exchange ?

A Bill of Exchange is required in scenarios where there is a need to formalize payment obligations, particularly when the payment is deferred, or financial security is required. Below are the key situations when a Bill of Exchange is necessary:

1. Trade Transactions

- Domestic Trade: When a seller provides goods or services on credit to a buyer and wants a legally binding assurance of payment.

- International Trade: To mitigate risks in cross-border transactions where parties may not have direct trust or legal recourse.

Example: An exporter issues a Bill of Exchange to the importer, ensuring payment on receiving the goods.

2. Credit Sales

- Deferred Payments: When payment is agreed to be made at a later date, a Bill of Exchange formalizes the credit terms.

- Installment Payments: When payments are split over time.

Example: A supplier provides machinery to a company and issues a bill to ensure payment after six months.

3. Loan or Credit Agreements

- To document and secure the repayment of a loan or credit extended by one party to another.

Example: A lender uses a Bill of Exchange to establish the repayment terms for a short-term loan.

4. Debt Restructuring

- Settlement of Past Due Amounts: When parties agree to settle overdue debts

Where is required Bills of Exchange ?

A Bill of Exchange is required in various sectors and settings where formalizing payment obligations is essential. Below are the key areas and locations where a Bill of Exchange is typically used:

1. Domestic Trade

- Wholesale and Retail Markets: To document credit transactions between suppliers and retailers.

- Local Business Transactions: When businesses buy and sell goods or services on credit within the same country.

2. International Trade

- Export and Import Transactions: To safeguard payments between exporters and importers across borders.

- Shipping and Logistics: When goods are transported internationally, a Bill of Exchange ensures the seller gets paid.

Example: An exporter in the USA issues a Bill of Exchange to an importer in Europe, formalizing the payment terms for goods shipped.

3. Financial Institutions

- Banks:

- Facilitate trade finance through documentary Bills of Exchange.

- Rediscounting bills for businesses to provide liquidity.

- Non-Banking Financial Companies (NBFCs): Use Bills of Exchange as collateral for short-term loans.

4. Legal and Judicial Systems

- Debt Enforcement: In courts, a Bill of Exchange can be used as evidence of a payment obligation.

- Dispute Resolution: When payment terms are contested, a Bill of Exchange serves as proof of agreement.

5. Corporate Sector

- Inter-company Transactions: For payments between associated companies or subsidiaries.

- Credit Sales: Used by corporations to manage deferred payments for large orders or capital equipment.

6. Public Sector

- Infrastructure Projects: Governments and contractors may use Bills of Exchange for staggered payments.

- Public Procurement: To ensure timely payment for goods or services supplied to government agencies.

7. Small and Medium Enterprises (SMEs)

- To secure payments from clients in cases of credit sales or deferred payments.

8. Debt and Loan Markets

Loan Agreements: Between lenders and borrowers to formalize repayment schedules.

**Debt Restructuring

How is required Bills of Exchange ?

The process of requiring a Bill of Exchange involves several steps to ensure it is properly drafted, executed, and legally enforceable. Here’s how a Bill of Exchange is typically required and created:

1. Agreement Between Parties

Before issuing a Bill of Exchange, the involved parties (drawer, drawee, and payee) must agree on:

- The amount to be paid.

- The payment date or timeline.

- Any specific terms of the transaction (e.g., trade agreement, loan repayment).

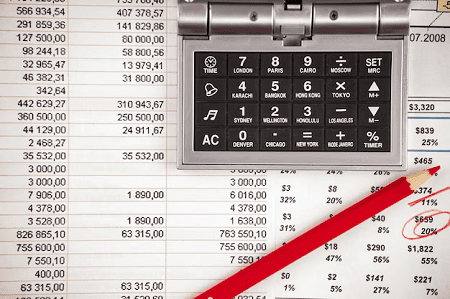

2. Drafting the Bill of Exchange

The drawer (the person requiring payment) prepares the Bill of Exchange. It must include:

- Date of Issue: The date the bill is created.

- Drawer’s Details: Name and address of the person or entity issuing the bill.

- Drawee’s Details: Name and address of the person or entity who must pay.

- Payee’s Details: Name of the person or entity to whom the payment will be made.

- Amount: The exact sum of money to be paid, both in figures and words.

- Payment Date: The due date for payment, or state “on demand” for immediate payment.

- Place of Payment: The location where the payment will be made.

- Signature of Drawer: A valid signature to authenticate the bill.

3. Presentation to the Drawee

- The Bill of Exchange is presented to the drawee (payer) for acceptance. The drawee must agree to the terms and sign the bill to acknowledge their obligation to pay.

- Acceptance can be:

- General: Unconditional acceptance to pay as specified.

- Qualified: Acceptance with specific conditions (e.g., partial payment or deferred date).

4. Delivery to Payee

- After acceptance, the bill is handed over to the payee (or kept by the drawer if they are also the payee).

- The payee holds the bill until the payment is due.

5. Payment at Maturity

- On the due date, the payee presents the Bill of Exchange to the drawee for payment.

- If the drawee defaults, the payee can take legal action based on the bill.

6. Negotiation and Transfer (Optional)

- A Bill of Exchange can be transferred by endorsement to another party before maturity. The new holder becomes the payee and is entitled to receive payment.

Legal and Practical Considerations

- Ensure compliance with local laws governing Bills of Exchange (e.g., Negotiable Instruments Act in some countries).

- Keep records of all related documents for legal and financial auditing purposes.

- Use clear and unambiguous language to avoid disputes.

By following these steps, a Bill of Exchange can be effectively drafted and enforced as a formal payment instrument.

Case study is Bills of Exchange ?

Case Study: Bills of Exchange in International Trade

Scenario:

ABC Ltd., an exporter in India, sells goods worth $50,000 to XYZ Ltd., an importer in the United States. The payment terms stipulate that XYZ Ltd. will pay the amount in 60 days after receiving the goods.

Steps in the Case Study:

1. Agreement Between Parties

- Exporter (ABC Ltd.): Wants a guarantee of payment within 60 days.

- Importer (XYZ Ltd.): Agrees to pay after 60 days but requires time to inspect the goods and arrange funds.

2. Drafting the Bill of Exchange

- ABC Ltd. (Drawer) drafts a Bill of Exchange directed to XYZ Ltd. (Drawee) with the following details:

- Amount: $50,000.

- Payment Date: 60 days from the bill’s date of issuance.

- Place of Payment: XYZ Ltd.’s bank in the United States.

- Payee: ABC Ltd. (or its bank).

3. Acceptance of the Bill

- XYZ Ltd. receives the Bill of Exchange and accepts it by signing. This action legally binds XYZ Ltd. to pay $50,000 on the due date.

4. Submission to Bank

- ABC Ltd. submits the accepted Bill of Exchange to its bank (Bank A) for safekeeping or discounting:

- Safekeeping: The bank holds the bill until maturity.

- Discounting: The bank provides ABC Ltd. with the amount (minus a discount/fee) before the due date.

5. Maturity and Payment

- On the due date, XYZ Ltd. pays $50,000 to Bank A through its own bank (Bank B).

- Bank A transfers the amount to ABC Ltd.

6. Non-Payment Scenario (Dishonor of Bill)

If XYZ Ltd. fails to pay, Bank A or ABC Ltd. can:

- Present the dishonored bill to XYZ Ltd. again.

- File a legal case to recover the payment.

Learning Outcomes

- A Bill of Exchange facilitates trade by formalizing credit terms.

- It reduces the risk of non-payment, especially in international trade, as it is a legally binding document.

- It provides financial flexibility to exporters through discounting.

Conclusion

This case study demonstrates how a Bill of Exchange ensures payment security and streamlines financial transactions in trade, benefiting both exporters and importers.

White paper on is Bill of exchange ?

White Paper on Bills of Exchange: A Comprehensive Overview

Introduction

The Bill of Exchange is a fundamental financial instrument used globally in trade and commerce. It formalizes credit transactions by creating a legally enforceable document that specifies the payment terms agreed upon by the parties. This white paper explores the origins, purpose, operational mechanics, and modern applications of Bills of Exchange, emphasizing their role in both domestic and international trade.

1. What is a Bill of Exchange?

A Bill of Exchange is a written, negotiable instrument that contains an unconditional order, requiring one party (the drawee) to pay a specified sum of money to another party (the payee) either on demand or at a predetermined future date.

Key Characteristics:

- Unconditional Order: No contingencies attached to the payment obligation.

- Three Parties Involved:

- Drawer: Issues the bill.

- Drawee: Person or entity obligated to pay.

- Payee: Recipient of the payment.

- Legally Binding: Enforceable under negotiable instrument laws (e.g., the Negotiable Instruments Act of 1881 in India).

- Negotiability: Can be transferred by endorsement or delivery.

2. Historical Context

The origins of the Bill of Exchange trace back to ancient trade routes in the Middle Ages, where merchants needed a reliable and secure method of ensuring payment across long distances. By the Renaissance, it had become a cornerstone of international commerce, particularly in Europe.

3. Operational Framework

Drafting a Bill of Exchange

A typical Bill of Exchange includes:

- Date of issue.

- Amount payable (in words and figures).

- Name and address of the drawee.

- Name of the payee.

- Due date or payment term (e.g., “60 days after sight”).

- Place of payment.

- Drawer’s signature.

Acceptance and Payment

- Acceptance: The drawee acknowledges the obligation to pay by signing the bill.

- Payment: On the due date, the payee presents the bill to the drawee for payment.

Dishonor of Bill

If the drawee fails to pay, the bill is dishonored, and the holder can take legal action for recovery.

4. Applications of Bills of Exchange

- Domestic Trade:

- Used for credit sales to secure future payments.

- International Trade:

- Ensures payment across borders, often facilitated through banks as documentary bills.

- Short-term Financing:

- Businesses can discount bills with banks for immediate liquidity.

- Legal Evidence:

- Acts as a written agreement enforceable in court.

5. Advantages

- Payment Security: Provides legal assurance to the payee.

- Flexibility: Supports deferred payment arrangements.

- Negotiability: Allows transfer to third parties.

- Transparency: Clearly defines the terms of payment.

6. Challenges and Risks

- Dishonor Risk: Payment failure by the drawee.

- Currency Fluctuations: In international trade, exchange rate volatility can impact settlements.

- Forgery: Risk of falsified bills in certain scenarios.

- Legal Disputes: Ambiguities in terms may lead to disagreements.

7. Modern Usage and Digital Transformation

With advancements in financial technology (FinTech), Bills of Exchange have seen digitization:

- E-Bills of Exchange: Digital versions reduce fraud and streamline international trade.

- Blockchain Technology: Ensures secure, tamper-proof records.

- Integration with Trade Finance Platforms: Facilitates seamless processing of payments in global commerce.

8. Case Study: A Practical Example

Scenario:

- ABC Ltd. in the UK exports machinery worth $100,000 to XYZ Ltd. in the US.

- A 90-day Bill of Exchange is drawn by ABC Ltd. and accepted by XYZ Ltd.

- ABC Ltd. discounts the bill with its bank, receiving immediate funds.

- XYZ Ltd. pays the bank on maturity.

9. Regulatory Framework

Bills of Exchange are governed

Industrial application of bill of exchange ?

Industrial Applications of Bills of Exchange

A Bill of Exchange plays a critical role across various industries, particularly in scenarios involving credit transactions, deferred payments, and international trade. Here’s an in-depth look at its applications across different industrial sectors:

1. Manufacturing Industry

- Procurement of Raw Materials:

- Manufacturers often procure raw materials on credit and issue a Bill of Exchange to suppliers, agreeing to pay at a future date.

- Machinery and Equipment Purchase:

- Capital-intensive purchases are often backed by Bills of Exchange to ensure payment security for the supplier while allowing the manufacturer time for installment payments.

Example: A steel manufacturer issues a 90-day Bill of Exchange to its iron ore supplier.

2. Export and Import Industry

- International Trade Transactions:

- Bills of Exchange facilitate payment between exporters and importers, ensuring exporters receive payment after goods are shipped and inspected.

- Documentary Bills:

- Used alongside shipping documents to guarantee payment once specific conditions (e.g., delivery confirmation) are met.

Example: An exporter in China ships goods to a buyer in the USA, issuing a Bill of Exchange for payment 60 days after delivery.

3. Retail and Wholesale Trade

- Credit Sales:

- Wholesalers issue Bills of Exchange to suppliers, allowing them to manage inventory while deferring payments.

- Large Retail Chains:

- Retailers may negotiate bulk purchases with deferred payment terms, formalized through Bills of Exchange.

Example: A supermarket chain in the UK uses Bills of Exchange to secure a three-month credit period for goods purchased from local suppliers.

4. Construction and Real Estate

- Infrastructure Projects:

- Contractors issue Bills of Exchange to suppliers for materials and equipment, as project payments are often milestone-based.

- Real Estate Transactions:

- Buyers may use Bills of Exchange to secure payment obligations for property purchases, particularly in commercial real estate.

Example: A construction company in Dubai issues a 120-day Bill of Exchange to a cement supplier as part of a large-scale project.

5. Energy and Utilities

- Oil and Gas Sector:

- Companies purchase crude oil or natural gas in bulk on credit, often using Bills of Exchange to formalize payment obligations.

- Renewable Energy Projects:

- Investors and developers use Bills of Exchange to manage deferred payments for wind turbines, solar panels, and other equipment.

Example: An energy company in Europe uses a Bill of Exchange to pay a supplier for wind turbines over a six-month period.

Research and development is bill of exchange ?

Research and Development (R&D) and Bills of Exchange: A Connection

While Research and Development (R&D) activities are typically associated with innovation and intellectual capital, the Bill of Exchange plays an indirect but crucial role in financing and facilitating the operational aspects of R&D projects. Here’s how the two can intersect:

1. Role of Bills of Exchange in R&D

R&D projects often require substantial investment in materials, equipment, and services, which might not be paid for immediately. In such cases, Bills of Exchange can act as a financial tool to:

- Secure Credit for Supplies and Equipment:

- Suppliers of specialized equipment or raw materials used in R&D may accept Bills of Exchange as deferred payment instruments.

- Manage Project Cash Flow:

- Organizations conducting R&D may use Bills of Exchange to synchronize cash flow with funding cycles or grant disbursements.

- Facilitate Collaboration:

- In joint R&D ventures, one party may issue a Bill of Exchange to another for shared expenses or resource procurement.

2. Examples in R&D Contexts

Example 1: Procurement of Specialized Equipment

A pharmaceutical company researching a new drug procures advanced lab equipment from an international supplier. Instead of immediate payment, the company issues a Bill of Exchange with a 90-day payment term, allowing time to complete trials and secure additional funding.

Example 2: Academic and Industry Partnerships

A university collaborates with a tech firm on an AI development project. The university issues a Bill of Exchange to cover software licensing costs, payable after grant funds are released.

Example 3: Financing R&D Startups

An investor funds a biotech startup by accepting a Bill of Exchange that ensures payment upon the startup’s receipt of government R&D incentives.

3. Benefits of Using Bills of Exchange in R&D

- Flexible Financing: Allows R&D organizations to defer payments and allocate funds strategically.

- Strengthened Supplier Relationships: Ensures trust and cooperation with vendors who accept deferred payments.

- Legal and Enforceable: Provides a formal, legally binding document to secure obligations.

4. Challenges

- Risk of Non-Payment: The drawee’s financial instability could lead to dishonor of the bill.

- Limited Use for Intangible Costs: Bills of Exchange are less applicable for non-tangible R&D expenses like salaries or intellectual property acquisition.

- Dependency on Creditworthiness: Suppliers may require strong credit histories before accepting a Bill of Exchange.

5. Conclusion

While a Bill of Exchange is not directly tied to the intellectual aspects of R&D, it is a valuable tool for managing the financial transactions that underpin research activities. By enabling deferred payments and facilitating cash flow, it supports innovation and development processes, particularly in sectors with high upfront costs and long project timelines.

Courtesy : VishwasCA

References

^ Rogers, James Steven. The Early History of the Law of Bills and Notes: A Study of the Origins of Anglo-American Commercial Law. Cambridge University Press. p. 3.

^ Bills of Exchange Act 1909 (Cth)

^ Durant, Will (1944). Caesar and Christ: a history of Roman civilization and of Christianity from their beginnings to A.D. 325. The story of civilization. Vol. 3. New York: Simon & Schuster. p. 749.

^ “Ancient Roman IOUs Found Beneath Bloomberg’s New London HQ”. 2016-06-01. Archived from the original on June 2, 2016. Retrieved 2018-06-09.

^ Moshenskyi, Sergii (2008). History of the Weksel. Xlibris Corporation. ISBN 978-1-4363-0693-5.

^ Templar Order. doi:10.1163/1877-5888_rpp_com_125078.

^ Martin, Sean (2004). The Knights Templar : the history and myths of the legendary military order (1st Thunder’s Mouth Press ed.). New York: Thunder’s Mouth Press. ISBN 978-1560256458. OCLC 57175151.

^ Adam Anderson, An historical and chronological deduction of the origin of commerce: from the earliest accounts to the present time. Containing, an history of the great commercial interests of the British empire…, Vol. I, p.209–210 (1764)

^ Chisholm, Hugh, ed. (1911). “Bill of Exchange” . Encyclopædia Britannica. Vol. 3 (11th ed.). Cambridge University Press. pp. 940–943.

^ Read, Frederick (1926). “The Origin, Early History, and Later Development of Bills of Exchange and Certain Other Negotiable Instruments”. Canadian Bar Review. 4 (7): 440–450.

^ Jump up to:a b c d Greenlee MB, Fitzpatrck IV TJ. (2008). Reconsidering the Application of the Holder in Due Course Rule to Home Mortgage Notes. Federal Reserve Bank of Cleveland.

^ Jacob J. Rabinowitz (May 1956). “The Origin of the Negotiable Promissory Note”. University of Pennsylvania Law Review. 104 (7): 927–939. doi:10.2307/3310431. JSTOR 3310431. S2CID 152366234.

^ Szalay Zs. – Vértesy L. – Novák Zs. “Strengthening the Small and Medium Enterprise Sector by Switching to Bills and Notes – Public Finance Quarterly Archive Articles”. www.penzugyiszemle.hu (3): 411–429. doi:10.35551/pfq_2020_3_6. S2CID 226460388. Retrieved 2020-12-27.

^ “THE NEGOTIABLE INSTRUMENTS ACT, 1881” (PDF). Legislative Department. Government of India. Retrieved 13 November 2023.

^ “Uniform Commercial Code – Article 3”. Law.cornell.edu. Retrieved 2014-06-23.

^ “Articles of the Uniform Commercial Code”. Uniformcommercialcode.uslegal.com. Retrieved 2014-06-23.

^ Collins Dictionary of the English Language, 2nd Edition, London, 1986, pp.504-5; Cassell’s Latin Dictionary, Marchant, J.R.V, & Charles, Joseph F., (Eds.), Revised Edition, 1928, p.182

^ “Article 3, Sections 206(b)”. Law.cornell.edu. Retrieved 2014-06-23.

^ Mann RJ (1996). Searching for Negotiability in Payment and Credit Systems. UCLA Law Review.